General summary

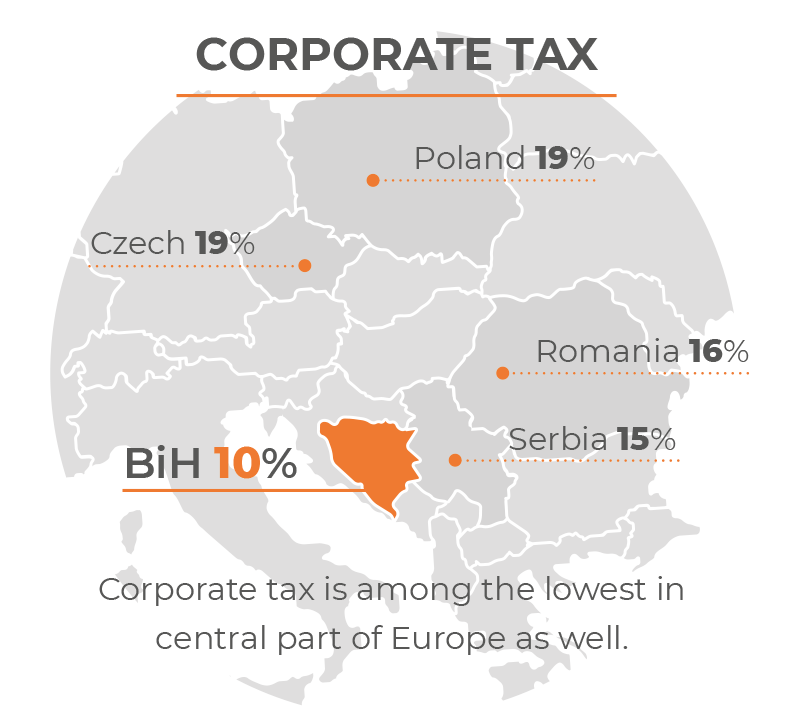

Bosnia and Herzegovina is the country with the lowest tax rates in Europe. BH has a single flat income taxation rate of 10 %, with additional incentives for employees.

The personal income tax rate in Bosnia and Herzegovina stands at 10 %.

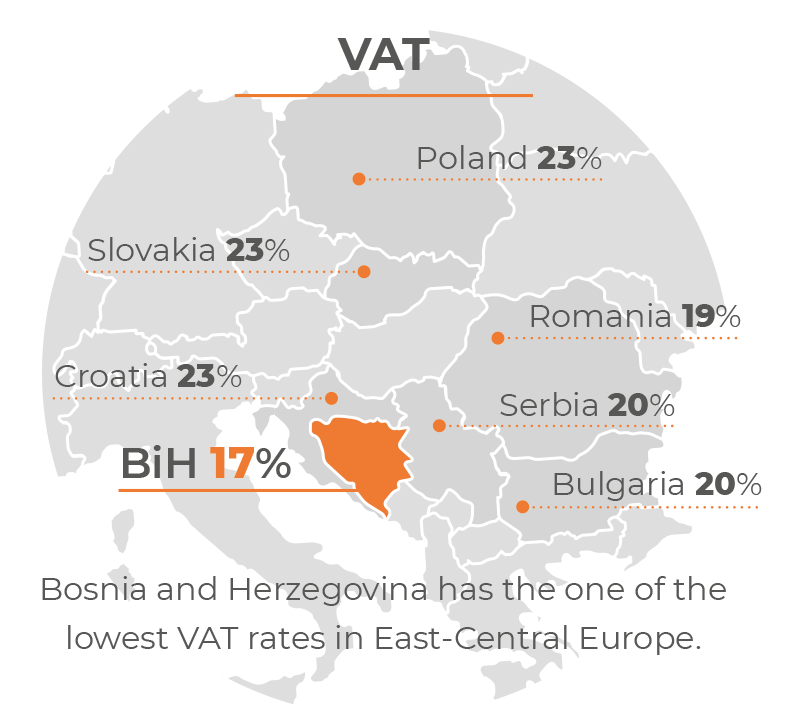

These tax rates make BH extremely competitive in Europe, where the average corporate tax rate amounts to 30 %.

The Central Bank of Bosnia and Herzegovina, as the county’s monetary authority, maintains monetary stability, with full coverage in freely convertible foreign exchange funds under a fixed exchange rate of 1 BAM: EUR 0.51129.

There are 27 commercial banks operating in BH. 24 banks operating in BH are members of the deposit insurance program, which provides insurance amounting to €25,000.

The BH financial system relies on the use of International accounting standards, while the financial sector and banking in Bosnia and Herzegovina are among the most stable in Southeast Europe.

Agreements on Avoidance of Double Taxation

Bosnia and Herzegovina has Agreements on Avoidance of Double Taxation with the following countries:

Albania, Algeria, Austria, Azerbaijan, Belgium, China, Croatia, Czech Republic, Cyprus, Denmark, Egypt, Finland, France, Germany, Greece, Iran, Ireland, Italy, Jordan, Kuwait, Hungary, Malaysia, Macedonia, Montenegro, Moldova, Netherlands, Norway, Pakistan, Poland, Romania, Slovakia, Slovenia, Serbia, Spain, Sweden, Sri Lanka, Turkey, United Arab Emirates, United Kingdom and Northern Ireland, Qatar.

Taxation percentages in the region

- In Croatia taxes amount to 12%, 25% and 40%

- In Serbia from 10%, 15% and 20%

- In Slovenia, taxes range from 16% to 41%

- In other EU countries income taxes fall in the range of 15% to 51%, without social contributions.

Sources: Agency for Statistics of the Bosnia and Herzegovina

Last updated: 18/2-2019